What Do I Need to Open a Bank Account at Bank of America

The good old United states of america of A. Possibly you are a frequent traveler there, looking for a practical way to practice business concern there, or you are an American that lives abroad and needs a user-friendly way to avoid high international fees. Whatever your reasons, opening a bank account in the world's largest economy tin come up with many benefits, although, if you lot are a not-resident, you might face several challenges if y'all don't know exactly where to look!

Despite being a very technologically advanced state, the U.s. banking earth is known for still being rather old school. Not only practise they carry hefty foreign transaction fees and aren't particularly multi-currency friendly, but online cyberbanking tin can also leave a lot to exist desired. The majority of banks rely heavily on face-to-face interaction (including some instances when your account gets suddenly locked), and even accessing your bank from abroad sends upward an immediate red flag for many - definitely a less than ideal situation for a global citizen, digital nomad, or international entrepreneur.

In fact, I think the days where I had to visit my Us bank branch every time I was going abroad to relay my whole travel itinerary so that they wouldn't decide to block my 'suspicious' action and exit me penniless on my trip (and in one example, they still blocked it anyways 🙄)

Withal, there is no demand to experience disheartened. While this can happen in some circumstances, a large portion of US banks are increasingly greenhorn-friendly, and contrary to belief, many will at present let y'all to open up US bank accounts without a social security number!

Table of Contents ↺

- What you will need

- Preparation is central

- Opening a personal account

- Recommendations for personal accounts

- Wise Borderless

- Charles Schwab

- Hunt Personal

- Bank of America

- Opening a business organisation business relationship

- Recommendations for business accounts

- Wise Business organization

- Mercury

- Chase Business

- Citibank

- FAQs

What you lot will need

First of all, it'due south important to sympathize the various banking mural in the US. You lot take probably heard some of the big names like Bank of America, just there are also many regional and country-specific banks, credit unions, online banks, and investment banks. As a non-resident, we would recommend looking towards the bigger banks like Hunt Bank, Banking concern of America, or Citibank. To our knowledge, they are all open to non-residents. Smaller and more local banks have a lower run a risk threshold and will likely plow you lot away if you don't accept a United states of america address.

On elevation of that, the required documents y'all demand to submit in order to open an business relationship vary depending on the bank, state, or even branch. Notwithstanding, US residents volition more often than not be asked to submit the following for a personal checking business relationship:

- Social Security Number (SSN) or Individual Tax Identification Number (ITIN)

- Passport or ID

- US Address and proof of address (i.e a utility beak)

- Minimum deposit

- In some cases, a Us phone number to admission online banking

When the banks are dealing with non-residents, they will be looking for something to compensate for these documents in some way, so they can exist certain to open an business relationship while fulfilling all KYC and AML requirements.

If you are a US citizen living away, this should naturally be relatively easy to provide. For the The states address, you lot tin either use a shut relatives' or a mail forwarding service (although banks have started to become picky about these in recent years so an actual residential accost is preferred). Any of the major banks, every bit well as several online banks such as Ally Banking concern, Charles Schwab, and Capital One, will let you register remotely (just perhaps use a VPN and don't tell them yous live away!)

Equally for everyone else, depending on whether you lot desire to do this remotely, in person, or you are looking to gear up a business account, there may be some additional steps and requirements, as well every bit other options you should probably consider. We hope that with this article, we can help you find the best solution for you lot.

Grooming is fundamental

Thus, due to the ever-irresolute nature of banking policies, it's crucial to fix before approaching the banks. Recall in advance to check the requirements. Brand sure to verify:

- Do I demand an ITIN or SSN?

- Do I need a The states Address? What kind of proof do yous need?

- What'due south the minimum eolith?

- Exercise I demand to prove my source of funds somehow?

- Volition you accept this document?

It is vital to note that if you don't properly inquiry this and just caput direct to the bank, yous may even go disqualified to use at that bank over again.

As well, if you are going in person, we recommend finding a co-operative that is used to dealing with non-resident requests. If you walk into whatever sometime co-operative, some of the tellers may not be fully trained in dealing with these problems and will deem it not possible.

Now hopefully, we haven't scared y'all abroad with this alert, believe me, many people earlier you accept managed successfully. However, if after the preparation you are still unsure, and peculiarly if a trip to the US is off the cards and you lot are looking to exercise this remotely, we recommend seeking professional help from a specialty service dealing with non-resident banking.

❗ Beware, many services will say they can get you a United states bank business relationship as a non-resident without an SSN, merely a lot of them are scams and may be attempting to deceive y'all or pursue it through illegal means.

Nosotros can personally vouch for Global Banks, after hearing success stories from our ain contacts. Global Banks are ever kept upwardly to speed with all the latest policies and should exist able to aid you lot find a suitable banking concern in the United states through their contacts.

Please also be aware that if you lot intend to get a bank account without an SSN or ITIN, the minimum deposit may be a lot higher than usual, sometimes even above $10,000.

Opening a Personal Account

First of all, if yous don't have an SSN, having an ITIN will enormously improve your chances when applying for a US bank account. Well-nigh major banks likewise as others will have ITINs. Alliant Credit Union for instance, welcomes remote account openings from not-residents if they accept an ITIN.

An ITIN is a type of revenue enhancement identification that the IRS uses to certificate non-residents for tax purposes. The process is quite complicated and will require you to have some kind of connectedness to the Us, due to which you have to file tax returns in the United states. Yous can find info on which non-residents are required to file a revenue enhancement return on the IRS website. Likewise, it may be worth checking out IRS Certified Acceptance Agents (CAA) to help yous get an ITIN.

Nosotros have been thinking of writing a more than in-depth article almost how to get an ITIN for non-residents in the most future, so if you are interested, sign up for our newsletter and nosotros'll allow you know when it's ready!

If you don't feel similar heading downwards the ITIN path, contrary to popular belief it is still possible to open a non-resident account without an SSN or ITIN, merely it is not a total guarantee. Information technology depends significantly on having the right banking connections forth with several considerations such every bit nationality, tax residency, (blacklisted passports and citizens and residents in countries which the Usa has sanctions against will have a much harder fourth dimension), and your source of income.

Unfortunately, the list of possible banks is not evergreen. You lot tin pretty much guarantee that y'all will have an easier fourth dimension with well-nigh of the more than prominent brick and mortar banks since they are more than used to dealing with non-resident clients. The rules are constantly changing, so the required documents needed can vary by depository financial institution, state or even branch in some cases.

One bank that may not crave a social security number may change its heed in a month's time. Have COVID for instance, with travel becoming increasingly catchy, many banks became more flexible to fix an account remotely, considering that it is not equally piece of cake to visit the U.s. in person.

Recommendations for Personal Accounts

Wise Borderless

Wise, or Transferwise as it was formerly known, is the pioneer of borderless cyberbanking. It started as a fashion to send money abroad without large exchange fees and long waiting times by sending information technology between their ain international branches. It has since go a major player and competition to traditional banks, allowing yous to open up borderless depository financial institution accounts in several countries, including the U.s.a., and currency wallets for over l countries.

Depending on your reason for needing a The states account, you might desire to consider Wise or any of the other cracking fintech options available. Of course, it actually depends on your reason for needing a Us account. While fintech services are a good selection for quick transactional cyberbanking, it's probably better to salvage it for supplementary use and not to store large quantities of money. Overall, it all depends on your reasons for opening an account. Near people looking for a U.s.a. personal account will find that Wise is an like shooting fish in a barrel and reliable solution to satisfy their banking needs. If your reasons are more circuitous, you might desire to consider a brick-and-mortar option instead.

Wise at a glance

Highlights

Charles Schwab

We've covered Charles Schwab before, and information technology has to be the #1 Usa bank for digital nomads. And you can see why, considering they take no foreign transfer fees and refundable fees on foreign ATM withdrawals. They as well have no monthly or annual fees. They also claim you can open an account with them in 10 minutes online. These features all brand information technology very attractive for digital nomads and frequent travelers.

The flip side however is that they don't open their standard accounts for non-residents (but come across below for information about their international accounts). Fifty-fifty if you are a US-citizen living away, it's probably best not to mention it. If you have a US address you tin utilize, combined with a VPN, still, information technology should be ok. For non-residents, in that location are mail forwarding services out there that can take care of this part for a depression monthly fee. As an alternative, they have an international account option which doesn't require an SSN, ITIN, or United states address, and fifty-fifty comes with a debit card. The caveat to this choice is that it requires an initial $25,000 eolith to open up.

Finally, if you are looking for a good US investment option, Charles Schwab also offers brokerage accounts for individuals in over 100 countries and considering they are primarily an investment banking concern, they have college involvement rates than some other banks on the list at 0.05%

Charles Schwab at a glance

Highlights

Hunt Personal

We've heard positive things about non-residents opening accounts with Hunt. Their simple requirements brand it quite favorable on this list, as they simply need some kind of taxation identification number - either an SSN, ITIN, or EIN, and an ID which can be but a passport. Chase is a pretty common selection for Americans, and yous will find their ATMs all beyond the Us.

Their fees are pretty standard for a large banking concern. There is no minimum opening deposit and their monthly fees are $12 per month for the nearly basic program, $25 for their premium and Sapphire accounts. The fee can be waived if you maintain a sure remainder (depending on the plan), and for the bones program, it is also waivable if y'all have $500 or more in monthly direct deposits. Something to bear in heed is their strange transaction fees, which are unremarkably effectually 2-five% of the entire purchase. Also, their savings accounts' interest rate is currently 0.01%, which is definitely not the best you can find.

Chase at a glance

Banking concern of America

Depository financial institution of America volition by and large permit you to open an account every bit a non-resident for both personal and business use if you oft visit the Usa for work or studying, notwithstanding, they will crave you to encounter them in person. It depends, but it is known to be i of the most foreigner-friendly on the list. However, if you want admission to internet banking, you lot will demand a tax identification number (like with Hunt). Fees and conditions also vary depending on the country in which yous apply with Bank of America, simply monthly maintenance fees and minimum opening deposits are very low for all of their options. Strange transaction fees are 3%, only they have many international partner ATMs which will aid yous avoid extra withdrawal fees when taking out cash away.

Bank of America at a glance

Opening a Business organisation Business relationship

For a business business relationship, you will nigh likely need to ready an LLC in the US. It'due south a fairly painless process that tin can exist done in merely a few minutes online. Going the LLC route is definitely the almost comfortable way, as it is doubtful that you volition manage to open a Us banking concern business relationship equally a foreign entity.

While not impossible, yous need to evidence a long rails record of a business connexion to the US, a lot of coin to deposit, and peradventure even a personal history with the bank. Once you have an LLC, the good news is opening a banking concern account is also rather simple to do, even remotely.

When choosing which state to file your LLC, most people choose either Delaware, Wyoming, New Mexico, or Nevada. These four exercise not have any state taxes and offer the most foreigner-friendly business laws. If nosotros could choose one for digital nomads, it would be New Mexico. They offer a combination of favorable privacy laws, low costs, no tax on not-resident companies, and no annual reports or fees. Once you accept fix this up, you also need to utilise for an EIN (Employee Identification Number) a.k.a your LLC'southward tax number. For more detailed info on the process to become an LLC, check out the FAQ department below.

With brick and mortar banks, the response y'all might get to opening a not-resident account will vary. It's possible that many will ask you about your connexion to the Usa market, and if you have offices there. Maybe they volition crave a considerable deposit which might just not be an selection for you as well. There are lots of deciding factors to exist taken into business relationship and y'all volition likely accept to visit a branch in person at some point. Here are our tiptop choices, only remember, grooming is cardinal and it'due south worth a call earlier booking a trip to usa. You can also consult Global Banks for professional person advice on business accounts likewise.

Like with personal accounts, we recommend Wise for business too. In that location are many great fintech options in our article on the best business organisation banking company accounts to open from anywhere.

Recommendations for Business organization Accounts

Wise Business

In addition to supporting personal accounts, there is also Wise Business, which will give yous higher transfer amounts while yet keeping commutation rates at 0.five%. For both personal and business use y'all will also get your own debit card linked to your business relationship. It'due south definitely a good solution if yous have less complex needs and demand an like shooting fish in a barrel no-frills way to send and receive coin from the U.s.a. without being a resident or opening up a resident LLC for your business.

Wise Business organization at a glance

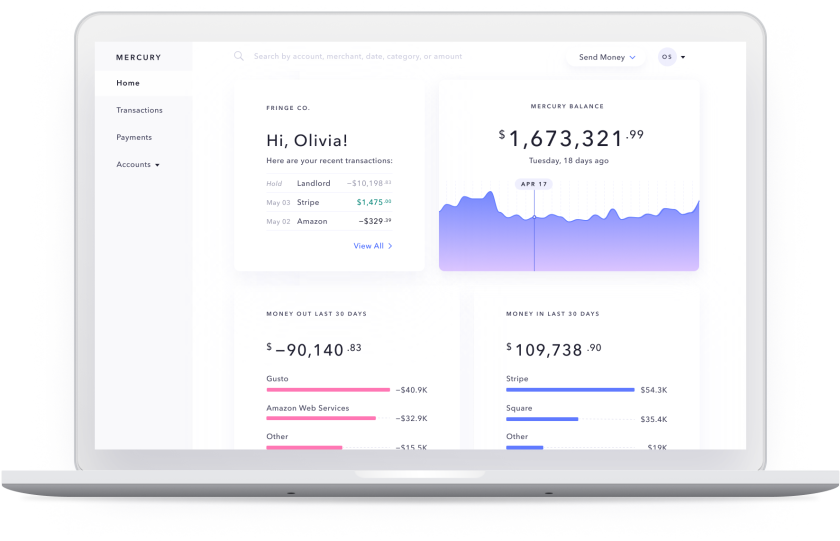

Mercury

Mercury is some other one we have featured before and we highly recommend information technology for US banking. Information technology is a Usa product that was built as a banking solution for tech get-go-ups. With Mercury, you will need to prepare an LLC, just the good news is that you don't demand to be physically in the United States to ready a business concern account with them, every bit y'all can do it from virtually anywhere except a few sanctioned countries.

To be honest, since the United states of america is the focus here, the ease Mercury provides for LLCs together with the low fees, high interest rates, and the multi-currency admission that Wise gives makes it without a doubtfulness the best choice when it comes to setting up a United states of america business account remotely.

Mercury at a glance

Chase Business

Chase for Business concern is a swell pick for business big and small, and one of the most well known banks in the United states. You won't be able to open your account fully remotely (exceptions may exist fabricated during the pandemic depending on your business volume and whether you have an ITIN or SSN), notwithstanding most of the initial work can be done online. We recommend them because you just need a minimum of a $2,000 daily balance to avoid the $fifteen fee, which is relatively low compared to the general The states marketplace. They also have quite a big selection of business credit cards with all sorts of travel rewards. As mentioned earlier, Hunt is too a great option for non-resident personal accounts, and it'southward besides quite like shooting fish in a barrel to link them together if yous wish.

Hunt Concern at a glance

Citibank

Citibank is another great choice for businesses, likewise letting you lot open a company account with your LLC. If y'all are CitiGold client, or at the very least, take a Citi business relationship from another developed country (such as Hong Kong or Singapore), it'due south possible to do this remotely too. Behave in listen, nonetheless, that the minimum deposit for doing things remotely is $15,000, so depending on your restraints, it might be more worth it to proceed a trip to u.s. instead to sort it.

It is a very international bank with around 700 branches in the US and over 1800 branches overseas in 160+ countries, and there are suitable plans for both pocket-size and large businesses, starting with their virtually basic account, CitiBusiness Streamlined. In this i, you can not make more than 250 transactions per month and the monthly fees are $15 per month, which can be waived if you maintain a $5000 account residual. Their programme for larger businesses has no limit on monthly transactions but the monthly fee is increased to $22 per month. Overall the interest rates on their business accounts are more favorable than Chase at 0.05%. Foreign transaction fees are up to 3%.

Citibank at a glance

Frequently Asked Questions

FAQs ↺

- What are the advantages and disadvantages of having a US Bank business relationship?

- How practise I become a US credit card?

- What are the tax implications of having a non-resident business relationship?

- What do I need to form an LLC?

- Do I need a The states address?

What are the advantages and disadvantages of having a U.s.a. Bank account?

Let's start with the pro's 👍

With the The states dollar being the globe's banking currency, and the land of the free being a apparent state worldwide, it brings a lot of international leverage. Since there is a high caste of trust for transfers coming from U.s.a. accounts, US banking is very smooth and efficient and will not receive the aforementioned corporeality of scrutiny as bank accounts from some countries.

In addition, the United states of america does not provide any info to other countries well-nigh their taxpayers, meaning you tin can enjoy a great deal of privacy with a US bank account. The funny affair is, the US expects other countries to share this data regarding US taxpayers abroad - that's the kind of negotiation power the U.s. dollar has.

On the other hand 👎

Remember 2008? Their higher risk tolerance is what makes the United states of america a convenient place to bank, yet information technology as well means the The states has the highest charge per unit of bank failures in the developed world. It'southward just something to bear in mind if you are thinking of putting all your life savings in a US bank account.

On summit of that, it is very U.s. dollar-centric and the fees for strange transactions tin can sometimes be rather exorbitant if you are not careful. If y'all are going to be dealing with different currencies frequently, information technology is all-time to try out the fintech options instead (or a combination of both perhaps)

How do I go a United states credit menu?

Chances are, many who are looking for a The states bank account want a U.s. credit card, which offers some of the all-time reward rates in the world. Having no SSN in the US can make things challenging, but there are still options. Many major card issuers such equally Bank of America, American Limited, Hunt, and Uppercase 1 will take you if y'all take an ITIN. Without an ITIN, you accept little run a risk of getting approved.

The other of import hurdle for getting a United states of america credit card is proving a strong U.s. credit history. Unfortunately, the most mutual credit bureaus do not monitor international credit history, and so unless y'all exercise have some US credit history, you are probably not going to go the platinum! For that, it is all-time to look first at big international banks like HSBC, which will oft accept into consideration your credit history abroad and will allow you sign up for a U.s.a. credit card with no prior history.

If yous have no U.s. credit history, your best bet is to go an ITIN, sign up for a bank similar Bank of America and after some time request a secured credit card. Later on about a twelvemonth of responsible spending and on-time payments y'all'll likely have a practiced enough credit history to authorize for more interesting unsecured credit cards.

What are the revenue enhancement implications of having a non-resident business relationship?

If you are a then-called "US person for taxation reasons", you are probably subjected to citizenship-based tax already and required to submit a Us tax return. For those who are not citizens or a 'US person for tax reasons, you will only exist field of study to taxes on whatsoever US income or income "effectively continued with a US trade or business concern" i.due east you lot have a concrete United states of america performance with employees, bounds, or other physical assets. Non-resident LLCs will require yous to file an annual "advisory render" to the IRS, only again you will only pay taxes in relation to any US merchandise or income (for example if you accept employees or contractors in the US).

Non-residents are exempt from paying any revenue enhancement on the interest you may receive from depository financial institution deposits, savings & loan institutions, credit unions, insurance companies, or portfolio interest. The same applies in that you are only exempt if there is no connexion to any Usa trade or business.

What do I need to grade an LLC?

First of all, a name that complies with the rules in the state you lot are registering. Different states have different rules on how y'all can name your LLC. Then you will need to file the "Manufactures of Organization" which tin can exist done online very easily. Adjacent, appoint a registered amanuensis who will accept all legal and other concern mail on the LLC'southward behalf. This is a person who has a concrete address registered in the land of your LLC, but there are numerous individual service companies who will do this for y'all for a fee. And so, you must employ for an EIN on the IRS website. You must practise this even if your LLC has no employees.

Practice I demand a Us accost?

You should clarify with the depository financial institution if they are after a physical United states of america address where you can live or a postal accost. United states of america banking relies a lot on sending mail (for example when you are waiting to receive your card) so for many banks, a postal address or PO box should be enough. However, some might be looking for proof that y'all live at the accost (eastward.1000. your phone bill) so it's of import to bank check, as this will determine if the banking concern is compatible with you lot. Some are pickier than others.

Permit me know in the comments if you know any other adept options, or if yous have any feedback nigh whatsoever of the ones I listed above!

Source: https://nomadgate.com/us-bank-account-non-residents/

0 Response to "What Do I Need to Open a Bank Account at Bank of America"

Post a Comment