e. perform a common size analysis. what has happened to the composition

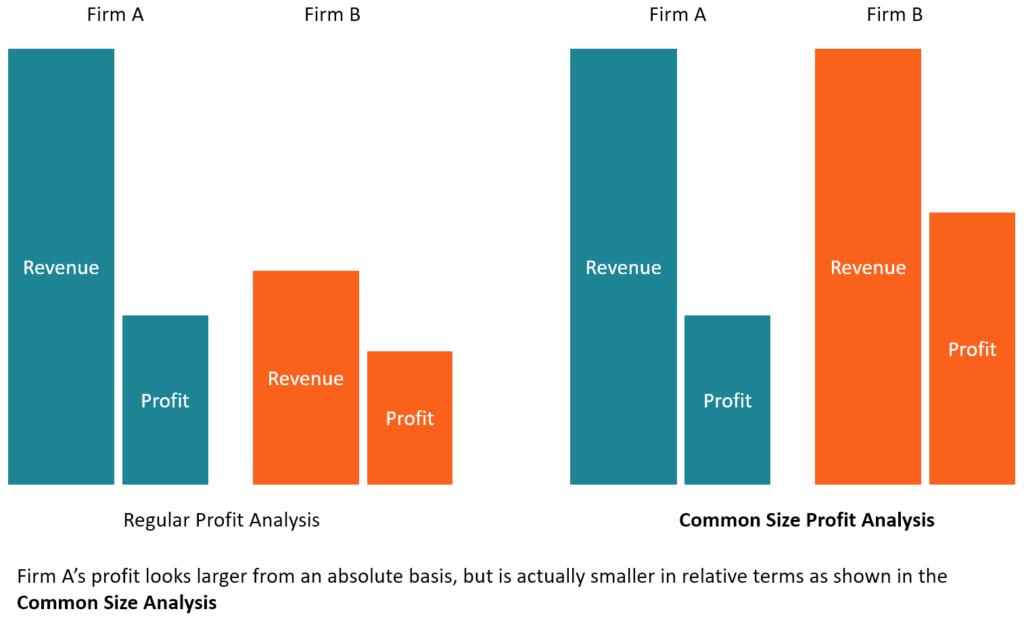

What is Common Size Analysis?

Common size analysis, too referred as vertical assay, is a tool that financial managers use to analyze fiscal statements . It evaluates fiscal statements by expressing each line item every bit a percentage of the base amount for that period. The analysis helps to empathize the touch of each detail in the financial statement and its contribution to the resulting figure.

The technique tin be used to analyze the three primary financial statements, i.e., balance sail , income statement, and greenbacks catamenia statement . In the residue sheet, the mutual base of operations item to which other line items are expressed is total assets, while in the income statement, it is total revenues.

Formula for Mutual Size Analysis

Common size financial statement analysis is computed using the following formula:

Types of Common Size Assay

Common size analysis tin be conducted in two means, i.e., vertical assay and horizontal analysis. Vertical analysis refers to the assay of specific line items in relation to a base of operations item inside the same financial menstruum. For example, in the balance sail, we can appraise the proportion of inventory by dividing the inventory line using total avails as the base item.

On the other hand, horizontal assay refers to the analysis of specific line items and comparison them to a similar line item in the previous or subsequent financial period. Although common size assay is not as detailed as tendency analysis using ratios, information technology does provide a simple way for financial managers to analyze financial statements.

Balance Sheet Mutual Size Analysis

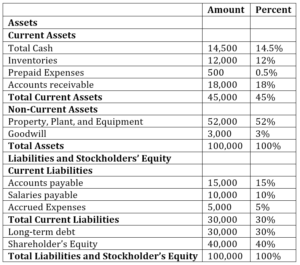

The rest canvas common size analysis more often than not uses the total assets value every bit the base value. On the balance sheet, the total assets value equals the value of full liabilities and shareholders' disinterestedness . A financial manager or investor uses the common size analysis to encounter how a house's capital structure compares to rivals. They can brand important observations by analyzing specific line items in relation to the total avails.

For example, if the value of long-term debts in relation to the total assets value is too loftier, it shows that the company'due south debt levels are too loftier. Similarly, looking at the retained earnings in relation to the total assets as the base value can reveal how much of the annual profits are retained on the balance sheet.

Permit's take the example of ABC Visitor whose balance canvass for 2017 is equally follows:

From the table in a higher place, we can deduce that greenbacks represents xiv.5% of the total assets while inventory represents 12% of the full assets. In the liabilities section, we can deduce that accounts payable stand for 15%, salaries 10%, long-term debt 30%, and shareholder's equity 40% of the total liabilities and stockholder'due south disinterestedness.

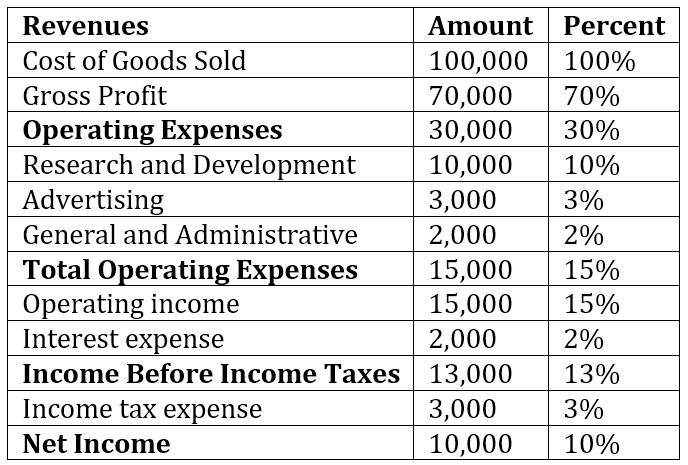

Income Statement Mutual Size Assay

The base item in the income statement is usually the total sales or total revenues. Common size analysis is used to calculate net profit margin, as well as gross and operating margins. The ratios tell investors and finance managers how the company is doing in terms of revenues, and they can make predictions of futurity revenues. Companies can also apply this tool to clarify competitors to know the proportion of revenues that goes to advertising, enquiry and development, and other essential expenses.

We can compute common size income statement analysis for ABC Company for 2017.

By looking at this income argument, we tin come across that in 2017, the amount of money that the visitor invested in research and development (ten%) and advertising (3%). The visitor also pays interest to the shareholders, which is ii% of the full revenue for the year.

The net operating income or earnings after interest and taxes represent 10% of the full revenues, and it shows the health of the business's core operating areas. The net income can be compared to the previous year's net income to meet how the company'due south performance year-on-year.

Importance of Mutual Size Analysis

One of the benefits of using common size assay is that it allows investors to identify drastic changes in a company's financial argument. It mainly applies when the financials are compared over a period of 2 or three years. Any significant movements in the financials across several years can assist investors decide whether to invest in the company.

For case, large drops in the company's profits in 2 or more consecutive years may signal that the company is going through financial distress. Similarly, considerable increases in the value of assets may hateful that the company is implementing an expansion or acquisition strategy, making the company attractive to investors.

Common size assay is also an fantabulous tool to compare companies of dissimilar sizes but in the aforementioned manufacture. Looking at their financial data tin can reveal their strategy and their largest expenses that give them a competitive edge over other comparable companies.

For example, some companies may sacrifice margins to gain a large market share, which increases revenues at the expense of turn a profit margins. Such a strategy allows the visitor to grow faster than comparable companies because they are more preferred by investors.

Download the Gratis Template

Enter your proper noun and electronic mail in the form below and download the free template now!

Common Size Analysis Template

Download the complimentary Excel template now to advance your finance knowledge!

Related Readings

Thanks for reading CFI's guide to Mutual Size Assay. To keep learning, the following CFI resource will be helpful:

- Assay of Fiscal Statements

- Projecting Income Statement Line Items

- Comparable Company Assay

- Fiscal Analysis Ratios Glossary

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/common-size-analysis/

0 Response to "e. perform a common size analysis. what has happened to the composition"

Post a Comment