Avoid Capital Gains on Home Sale to Family

The capital letter gains taxation on real estate when you lot sell your house is generally 15-20% of the capital letter gain from the home sale. That's a lot.

Always wonder how to avert paying taxes when selling a business firm?

If y'all do things right, you can actually avoid capital gains tax on the proceeds from the sale of your house by taking advantage of the capital letter gains tax exclusion for primary residence home sales.

This is a huge tax break for dwelling house sellers: you lot can exclude up to $250,000 in gain from taxes if you're single; $500,000 if married filing articulation.

This commodity explains exactly how the tax rules for selling a home work. The rules are tricky so pay attention to brand sure you don't accidentally disqualify yourself.

All homeowners thinking of selling their business firm — and even home buyers who just desire to larn how to be tax-efficient — tin get a LOT of value from understanding how the home auction exclusion works.

I structured this post as an FAQ. Simply I'll employ a bunch of examples to testify y'all how the nuances, exceptions, and limitations piece of work.

Click whatever of the links below to jump to each question.

What part of the revenue enhancement code is this?

Who qualifies for the exclusion?

What type of home qualifies?

How much tin can y'all exclude?

When can you claim the exclusion?

What does the exclusion hateful for tax purposes?

How many times can the exclusion on capital letter gains taxes exist claimed?

What special rules apply to married taxpayers?

Sometimes, married couples are treated every bit if they were not married…

Changes to the law back in 2009

No exclusion for "periods of nonqualified utilise"

What is "nonqualified apply"?

But some exceptions…

What happens for "periods of nonqualified use"?

Example #one: Simple example…

Instance #2: Unhappy uncomplicated case…

Example #three: More complication…

Example #4: Straddling the border

What happens when you fail to meet some of the requirements?

Examples of change in employment

Examples of change in health

Examples of other unforeseen circumstances

Dandy, yous're eligible for a partial exclusion! How is it actually calculated?

2 last notes about job changes, health, and other unforeseen circumstances

Depreciation recapture

Permit'southward starting time with the basics….

What part of the revenue enhancement code is this?

The statute that governs the $250k / $500k exclusion on home sale gains is:

26 U.S. Code § 121 – Exclusion of proceeds from auction of principal residence

This is from the Internal Revenue Lawmaking. Feel gratuitous to click and read and compare my explanations to the statute if you're unclear virtually anything.

Who qualifies for the exclusion?

People who satisfy the "two out of 5 twelvemonth rule." What is the 2 out of 5 year rule?

It is a test that the IRS uses that says: people who ain and use a domicile as a primary residence for at to the lowest degree ii of the 5 years immediately prior to selling their abode tin can qualify for the capital gains tax exclusion.

At that place are some exceptions to the 2 out of 5-year rule explained afterwards in this article. The exceptions allow you to merits a fractional home sale tax exclusion even when you sell your house inside (or less than) 2 years of ownership it. For instance, if you sell your business firm later 1 twelvemonth, y'all tin can still become a partial capital gains exclusion if you meet a few other conditions (explained below).

What blazon of home qualifies?

Basically, any home that is your principal residence. Doesn't matter if it's a single family home, condo, townhouse, whatsoever.

What determines whether a dwelling is your chief residence is whether you lot are physically living in the home.

This means y'all cannot avoid capital gains tax on the auction of a second abode. Y'all also cannot avoid capital letter gains tax on rental property. For rental belongings, you can use Section 1031 to do a 1031 exchange and defer taxation liability, but the majuscule gains exclusion provided past Department 121 does non utilize to rental property.

Can you lot avoid capital gains tax past ownership another house? No, you lot cannot – at to the lowest degree at the federal level. Some states or municipalities may accept exceptions for state or local taxation liability, (e.thousand. special property tax basis rules when you sell a firm and purchase another one), but not for federal tax liability which is where you lot'll pay the most in uppercase gains taxes anyway.

And then, whether you buy another house later selling your current master residence doesn't impact your federal capital gains tax liability: your eligibility for the capital gains exclusion is simply based on whether the home y'all are selling is your main residence.

In that location is likewise a common question re: at what historic period tin can you lot sell a house and not pay capital gains taxes. This is based on an outdated dominion that no longer applies that previously provided a special capital letter gains home auction exemption for over-55 seniors who are home sellers. The over-55 abode sale exemption was repealed post-obit the passage of the Taxpayer Relief Act of 1997. It was replaced by the mod Section 121 dwelling house sale taxation exclusion.

How much tin can you exclude?

The capital gains exemption allows you to exclude upward to a maximum of $250k proceeds if you're single, or $500k if you're married filing jointly.

If you lot sell your home for LESS gain than these amounts, the amount you can exclude will obviously exist less. Information technology's limited to your actual gain.

For you capitalists out at that place, you might be thinking: "What if I sell my business firm to my child or a family fellow member for $i or below market value?"

The taxation implications of selling your business firm below market value don't let you to avoid taxes. If you sell your house to a family member for $one, you won't have to pay capital gains taxes on the sale, merely you volition have to pay federal souvenir taxes, which are imputed as the difference between the sale amount and the fair market value of the property.

Federal gift revenue enhancement rates are higher than abode sale majuscule gains revenue enhancement rates, and then information technology'due south a worse deal to endeavour to avoid home sale capital gains taxes by selling your habitation beneath market value.

When can you claim the exclusion?

Upon the sale, commutation, or involuntary conversion of your primary residence. We'll talk more than later near what "commutation" and "involuntary conversion" mean.

What does the exclusion hateful for revenue enhancement purposes?

It means the capital gain from the auction of your dwelling house, up to $250k for single filers and $500k for married articulation filers, is excluded from your income.

How many times can the exclusion on capital gains taxes be claimed?

You lot can only claim this exclusion once every TWO years.

What special rules apply to married taxpayers?

In club to get double the exclusion amount, i.e., $500k:

- At least ONE spouse must own the habitation for ii of the 5 years prior to sale

- BOTH spouses must actually alive in the home as their primary residence for ii of the 5 years prior to sale

- NEITHER spouse can be in a "time out" considering of the "once every two years" limit noted above

If you and your spouse satisfy all these criteria, hooray — you get a $500k exclusion!

Sometimes, married couples are treated equally if they were non married…

But what happens when you or your spouse fail one of the criteria higher up?

Well, you don't get knocked out entirely.

What happens is, the IRS grants you an exclusion AS IF you were non married.

What that ways is, the IRS will evaluate each of you independently to run into what your own personal exclusion WOULD have been had you been a unmarried tax filer.

Furthermore, for purposes of that assay, the IRS will treat BOTH spouses as having owned the property whenever EITHER endemic the property.

In other words, if merely ONE spouse actually held title, the IRS volition fictionally assume BOTH spouses held championship at the aforementioned fourth dimension…but just for this ane analysis.

Notwithstanding much exclusion each of y'all would exist entitled to via this assay, the IRS volition accept the sum of both amounts and declare that as the total exclusion yous are jointly entitled to.

This may sound complicated, simply y'all can become a feel for how it works by considering the case where, say, a woman owns and lives in a dwelling for 3 years earlier marriage, then marries, and so ane month after her wedding decides to sell her business firm because the couple moves to a new metropolis for new jobs.

In that example, the husband volition fail the 2-year residency requirement, so the IRS will evaluate them separately, simply will fictionally presume the hubby owned the house for the same time the wife endemic the firm — 3 years.

And then the IRS will have whatever partial exclusion the husband is entitled to, add it to whatever exclusion the wife is entitled to, and and then declare the SUM to be the bodily exclusion the couple is jointly entitled to.

We'll see some detailed examples of this in a moment.

Changes to the law dorsum in 2009

In the simple days before 2009, the rules were simple.

As long every bit you satisfied the 2-yr residency requirement, yous could claim a nice fatty exclusion.

Merely starting in 2009, Congress decided information technology needed to raise more revenue enhancement revenue. So it amended the rules to make habitation sale capital letter gains tax exclusion more restrictive.

At present, you accept to meet the 2-year residency requirement PLUS check a few other boxes to become the full exclusion.

A lot of people will become defenseless past these changes, so allow's examine what they are….

No exclusion for "periods of nonqualified utilize"

Basically, the IRS now says, assuming you lot first see the ii-year residency requirement, you will only exist allowed to merits the taxation exclusion for "periods of qualified employ."

You can no longer get it for "periods of nonqualified use" even when you meet the residency requirement.

What's considered qualified vs. nonqualified use?

What is "nonqualified use"?

First, the IRS says the term "period of nonqualified use" ways whatever period starting January 1, 2009, when the home is not used equally a primary residence of the taxpayer or taxpayer'southward spouse.

So, anything before 2009 notwithstanding counts under the quondam law. The new restrictions merely employ starting January one, 2009.

That means if you bought your abode before 2009 and sold it during or later on 2009, then yous'll employ the old law to make up one's mind your taxation liability for the function earlier 2009, and then use the amended constabulary to determine your tax liability for the menstruation afterwards.

I hope that doesn't make your head want to explode.

Since the exam for primary residence is whether you lot are physically living in the home, then whatsoever time you are Non physically living in the home, the home is NOT considered your principal residence.

If y'all rent your dwelling house out, information technology's not your main residence. (Nevertheless, if you only rent out 1 room, you're still safe, only fractional depreciation rules will utilize to that room.)

If you lot live somewhere else for part of the year, similar a vacation domicile, then your regular home is not your master residence while you're away.

I don't call back the IRS will check too carefully if you are just going on vacation for ii weeks and living in hotels, fifty-fifty though I call up that technically means your home is not your main residence while you lot're away.

But some exceptions…

Even though the new rules effectually "nonqualified utilise" hateful the $250k / $500k tax exclusion is no longer simply adamant by the 2-year residency requirement, there are a few exceptions where not living in the habitation is nevertheless recognized by the IRS as permissible for tax exclusion purposes.

There are ii exceptions I want to indicate out in detail.

First, the menstruation between the LAST date the home is used as a main residence and the date the dwelling house is sold is Non considered nonqualified use.

To be articulate, information technology'due south not considered qualified use, either; it's just not NONqualified employ. Our examples later will show the significance of this distinction.

Second, whatever temporary absence, non exceeding 2 years, due to a change of employment, health condition, or other unforeseen circumstances likewise is not considered nonqualified utilize.

We'll define these terms: "employment," "wellness status," and "other unforeseen circumstances" in a moment.

What happens for "periods of nonqualified use"?

If role of your ownership period consists of nonqualified utilize, you won't go the full tax exclusion, fifty-fifty if you satisfy the 2-yr residency requirement.

Simply you might still go a partial tax exclusion…and if the gain is large enough you might even yet be able to get the full exclusion.

And think: all this nonqualified use stuff only applies to 2009 or later. Before that, there is no such concept and therefore no restrictions on the tax exclusion.

We'll show how all this works in our examples below.

So…if y'all can only claim part of the tax exclusion, exactly how much CAN you lot claim?

Information technology'll be a percentage. The style the IRS determines that percent is by creating a fraction.

The numerator of the fraction is the total days of nonqualified utilise while y'all endemic the habitation SINCE January 1, 2009.

The denominator is the total days you owned the dwelling, fifty-fifty before 2009.

That percent is what you CANNOT exclude from taxes. You can exclude the remainder. (The percentage is applied against your actual gain amount, not the max $250k/$500k threshold.)

Okay, enough theory.

Let's look at examples…

Instance #1: Simple case…

Permit'south say Victor and Victoria, a married couple, purchase a home for $1 million and sell information technology for $1.six million.

Victor and Victoria purchase their dwelling house Jan 1, 2018. They live there as their primary residence for 2 years plus 1 mean solar day, moving out January 1, 2020.

The next 24-hour interval, they hire out the house to a tenant, who leases it for 2 years plus 364 days — but shy of 3 years. They sell the house Dec 31, 2022, exactly 5 years afterwards buying it.

What are the revenue enhancement consequences?

Since their entire buying period occurs after 2009, simply the post-2009 regime applies.

In this case, Victor and Victoria volition get the total tax exclusion of $500k.

They satisfied the 2-yr residency requirement considering they lived in the house for 2 years and a day.

They also accept a valid exception to nonqualified use because the menstruum after the Final date the home was used as a primary residence (January 1, 2020) is Not considered nonqualified apply.

That'south truthful fifty-fifty though they rented out the home for nearly 3 years.

So, Victor and Victoria become the kickoff $500k proceeds excluded from taxes. They'll pay long-term capital gains taxes on the final $100k of gain.

Example #two: Unhappy uncomplicated instance…

Let's wait at a similar example. Same facts equally above, except here Victor and Victoria move out ane year plus 364 days after buying and occupying the firm — only shy of 2 years.

They rent out the house for the rest of the time until they sell at the five-yr mark.

Now, our unhappy couple fails to satisfy the 2-twelvemonth residency requirement.

Fifty-fifty though the menstruation after they move out is yet validly excepted from nonqualified utilize, they cannot claim any tax exclusion because they failed the 2-yr residency requirement.

And then they must pay long-term uppercase gains taxes on the entire proceeds of $600k. Bummer.

Example #three: More complexity…

Getting a footling more complicated, allow's say Victor and Victoria buy their dwelling house for $1 million on January 1, 2017.

They alive there one year and movement out December 31, 2017, and so Victoria can accept a 1-year chore rotation to a foreign branch office of her company. During their year abroad, they rent out their house.

The solar day afterward the tenant's lease ends on Dec 31, 2018, they move back in. They live in that location for 2 more years so move out once more Dec 31, 2020.

They discover a new tenant and start renting the house out the following day until they sell exactly 2 years later on Dec 31, 2022, for $1.6 million.

In this scenario, Victor and Victoria own the house for a total of 6 years.

iv discrete employ periods:

- Primary residency #1 (1 year from 1/1/17 – 12/31/17)

- Movement out for chore rotation (1 year from 1/1/18 – 12/31/xviii)

- Main residency #2 (2 years from 1/1/xix – 12/31/20)

- Move out to alter things up (2 years from 1/ane/21 – 12/31/22)

What are the tax consequences?

Victor and Victoria still go the full tax exclusion of $500k.

Get-go, the IRS looks back 5 years from the sale to evaluate the 2-year residency requirement. In this case, it was satisfied.

Side by side, nosotros determine that the earliest year of the lookback catamenia, 2018, does not count equally "nonqualified use," even though Victor and Victoria weren't living in the house, because they moved due to a job rotation which is a valid exception.

Finally, the last 2 rental years also don't count equally "nonqualified use" because of the exception after the Terminal date the dwelling house is used as a primary residence. So, 2021 and 2022 will not count equally "nonqualified employ."

That means, even though one-half the 6-year period was spent renting the house to tenants, Victor and Victoria tin still claim the total exclusion considering there are no periods of nonqualified use!

Victor and Victoria happily exclude the showtime $500k gain and so pay regular capital letter gains taxes on the concluding $100k.

Example #4: Straddling the edge

What nearly when the firm is purchased before 2009 and sold after 2009?

Aforementioned facts: Victor and Victoria buy for $1 one thousand thousand and sell for $1.half dozen million.

They purchase and movement in January 1, 2006. They move out ane year later and rent out the domicile for the next 4 years: 2007, 2008, 2009, and 2010.

They move back in 2011 and alive there exactly ane year before accepting a job rotation overseas. For that year away (2012), they rent out the house.

When they render, they move back in New year'southward Day 2013 and live there for 3 years before selling at the end of 2015.

What are the tax consequences?

They'll be able to claim 80% of the $600k tax exclusion (non 80% of the $500k max), simply they'll have to pay regular capital gains taxes on the other 20%.

Outset, we clarify whether they see the residency requirement: they do. They lived in the domicile for 4 years: 2011, 2013, 2014, and 2015.

Next, we know their job rotation year (2012) is a valid exception to "nonqualified use" fifty-fifty though they rented the house out.

Since they owned the home before 2009, we ignore all rental years before and then, because at that place is no such concept every bit nonqualified use before 2009.

We only analyze rental years starting 2009 — in this instance 2009 and 2010.

We take the ratio of nonqualified use to the total buying elapsing to compute how much gain CANNOT be excluded from taxes.

Hither, the numerator is 2 years for the rental catamenia of 2009 and 2010. (Call up, the chore rotation year 2012 is a valid exception.)

The denominator is ten years, the entire flow of ownership from 2006 – 2015.

So, that tells us we cannot claim the tax exclusion on twenty% of the gain, which means we can claim information technology on the other 80%.

Victor and Victoria can merits $480k in gain revenue enhancement-gratis — that's 80% of $600k. They'll pay regular upper-case letter gains taxes on $120k, or xx% (remember, they bought at $one million and sold at $1.6 1000000).

Nice!

What happens when you fail to run across some of the requirements?

Nosotros've seen that satisfying the requirements lets y'all exclude up to $250k / $500k from taxes.

And when y'all have some nonqualified use, you can all the same exclude some proceeds, as long as you encounter the other requirements.

Just if you fail the other requirements, you lot generally cannot exclude any gain from taxes.

But there is an of import exception: If you sell your home only don't meet the residency requirement, or you sell within two years of selling another abode, you MAY still be eligible for a partial exclusion IF the sale is due to a change in employment, health, or "other unforeseen circumstances."

What qualifies equally a "change in employment, health, or other unforeseen circumstances"?

The IRS has helpfully published regulations providing guidance and examples describing these scenarios. (Meet: "IRS Treasury Regulations Section 1.121–three.")

Let'south have a quick look…

Examples of alter in employment

The IRS says a dwelling house sale counts as "due to a change in employment" if the main reason for the sale is because your employment LOCATION changed.

The regulations apply something called a "condom harbor."

A condom harbor is a simple test you use to clarify your situation; "passing" the test ways the IRS automatically grants you a partial taxation exclusion.

Failing the test does non mean you lot lose the fractional exclusion. Information technology just means the IRS doesn't automatically grant information technology to y'all.

Perchance they'll need more than info before deciding. Or possibly they won't and they'll grant it to you anyway. Passing the safety harbor just "fast tracks" their assay. But declining it doesn't preclude you from a partial exclusion.

For job changes, the condom harbor is fifty miles.

That is, your abode sale is automatically accounted to exist caused past a task modify if your new task location is at to the lowest degree 50 miles farther from your firm than your old job. If you lot didn't have an old chore, then information technology'southward if your new chore location is at least 50 miles abroad from your house.

Important: That task modify must occur during the time yous own AND use your abode equally your master residence.

It doesn't matter if you start a brand new job, continue an old chore, or are self-employed. The but affair that matters is location, the alter in your commute distance.

Permit'south see how it works.

Example 1: Alex is unemployed and owns a townhouse that she has owned and used every bit her principal residence since 2021. In 2022, before satisfying the two-year residency requirement, Alex obtains a job that is 54 miles from her townhouse, and she sells the townhouse. Because the altitude between Alex's new place of employment and the townhouse is at least 50 miles, the auction is within the safe harbor and Alex can claim a fractional exclusion.

Example 2: Pecker is an Air Force officer stationed in Florida. Bill purchases a business firm in Florida in 2021. In May 2022, before satisfying the residency requirement, Bill moves out to have a 3-twelvemonth consignment in Germany. Pecker sells his house in January 2023. Because Pecker'south new job in Frg is at to the lowest degree 50 miles farther from his house than his erstwhile Florida task was, the sale is within the safe harbor and Beak can claim a partial exclusion.

Example iii: Crystal works in her firm's Philadelphia part. Crystal purchases a house in February 2020 that is 35 miles abroad from her function. In May 2021, before satisfying the residency requirement, Crystal begins an assignment in her company's Wilmington office 72 miles away from her business firm, so she moves out of the house. In June 2022, Crystal is assigned to piece of work in her business firm's London office. She sells her house in Baronial 2022 equally a consequence of the London assignment. The sale is non inside the safe harbor because her job change from Philly to Wilmington did non increase her commute distance past 50 miles (72 – 35 = 37). It's besides not protected by the safe harbor because of the London assignment because Crystal was not living in her house as her principal residence when she moved to London. Yet, Crystal is STILL entitled to a fractional exclusion because, nether her facts and circumstances, the main reason she sold her dwelling house WAS her modify in job location.

Instance 4: In July 2021 Donna, who works as an emergency medicine doc, buys a condo five miles from her hospital and lives in it equally her principal residence. In February 2022, Donna gets a chore at a new hospital that is 51 miles abroad from her condo. Donna may be called in to work unscheduled hours and, when called, must be able to arrive at work quickly. Because of the demands of her new chore, Donna sells her condo and buys a townhouse four miles away from her new hospital. Because Donna's new job is only 46 miles farther from her condo than her sometime job, the sale is not protected by the prophylactic harbor. Nonetheless, Donna can still merits a partial exclusion because, under her facts and circumstances, the principal reason she sold her condo was her job change.

Every bit yous can come across, the safe harbor guarantees the fractional exclusion, but its absence does non prevent the exclusion. It just ways y'all have to look at the facts and circumstances.

Examples of change in wellness

What about changes in wellness?

Basically, you lot get a fractional tax exclusion even when you don't satisfy the residency requirement if the chief reason you lot sold your home was to get medical care for an actual disease or injury that y'all or a family fellow member have.

Really, it's whenever ANY "qualified individual" has an disease or injury, merely if yous read the rules that unremarkably merely means you and your family. (See Treasury Regulations Section one.121–3(f) for the full run-down.)

Remember, it has to be an Actual illness or injury. If information technology's simply benign for your family's health and well-being, you can't merits the tax exclusion.

But like with task changes, the health exception also has a "safe harbor" test.

It's a physician'south recommendation.

That is, a abode sale is automatically accounted to be caused by a health condition if a licensed medico recommends that you move to get medical care. Yous should get your doc'due south recommendation in WRITING to avert any surprises.

Let's look at some examples.

Instance 1: In 2021, Apr buys a house and uses information technology as her primary residence. Then April is injured in an accident and unable to intendance for herself. April sells her house in 2022 and moves in with her daughter then that her daughter tin can care for her due to her injury. Under the facts and circumstances, the main reason for selling April'south abode is her health, so April is entitled to merits a fractional exclusion.

Example 2: Hank'south father has a chronic affliction. In 2021, Hank and Wendy purchase a business firm together and use it as their primary residence. In 2022 they sell the house to movement in with Hank's father so they can care for him as a result of his disease. Since the master reason for selling their home is for the health of Hank'south father, they are entitled to claim a partial tax exclusion.

Instance 3: John and Linda purchase a house in 2021 and apply it as their primary residence. Their son suffers from a chronic affliction requiring regular medical intendance. Later that twelvemonth their son begins a new treatment that is bachelor at a hospital 100 miles away from dwelling house. In 2022, John and Linda sell their house in club to exist closer to the hospital treating their son. Since the primary reason for the sale is to treat their son's illness, they are entitled to merits a fractional tax exclusion.

Instance iv: Ben, who has chronic asthma, purchases a firm in Minnesota in 2021 that he uses as his master residence. Ben's doc tells Ben that moving to a warm, dry climate would mitigate his asthma symptoms. In 2022, Ben sells his house and moves to Arizona to relieve his asthma symptoms. The sale is protected past the safety harbor then Ben is entitled to a partial tax exclusion.

Example 5: In 2021 Jill and Robert purchase a house in Michigan which they use every bit their master residence. Robert'south doctor tells Robert he should get more outdoor practice, but Robert is not suffering from any disease that can be treated or mitigated by outdoor exercise. In 2022 Jill and Robert sell their firm and movement to Florida so that Robert can increase his general level of do by playing golf twelvemonth-round. Because the home sale is merely beneficial to Robert'south wellness, it is not a valid exception and Jill and Robert cannot claim a partial tax exclusion.

Examples of other unforeseen circumstances

All right, what's the deal with "other unforeseen circumstances"?

Unforeseen circumstances are situations where your firm is sold or exchanged due to something not reasonably predictable and not in your control.

If the main reason for selling your firm is only due to "buyer's remorse" or due to an unexpected improvement in your financial situation, it won't qualify for a fractional exclusion.

Just as with job changes and health conditions, "other unforeseen circumstances" too has a "safe harbor" test.

The safe harbor kicks in if Any of the following happens while y'all own and live in your dwelling house:

- Involuntary conversion

- Natural or man-made disaster, war, or terrorism causing damage or devastation to your domicile

- Expiry of you lot or a family unit member

- Job loss making you or a family member eligible for unemployment benefits

- Modify in employment status (due east.g., reduced hours or pay) that makes you unable to pay housing costs and basic expenses (eastward.yard., nutrient, apparel, medical, taxes, transportation)

- Divorce or legal separation

- Multiple births resulting from the same pregnancy

The IRS may define other events equally "unforeseen circumstances" as well, just they'll do that instance by case, and when that happens they'll publish written announcements explaining whether those events are generally applicable to everyone.

Allow'south walk through some examples.

Case ane: In 2021 Alice buys a house in California and moves in. Shortly afterward, an earthquake causes damage to her house. Alice sells the firm in 2022. The sale is protected past the safe harbor and Alice tin merits a partial taxation exclusion.

Instance 2: Henry works as a instructor and Whitney works as a pilot. In 2021 they buy a house to live in every bit their main residence. Later that yr Whitney is furloughed from her chore for half-dozen months. The couple is unable to pay their mortgage and bones living expenses while Whitney is furloughed. They sell their house in 2022. The sale is within the rubber harbor and they tin can merits a fractional exclusion.

Example 3: In 2021, Howard and Winnie buy a ii-bed condo to use as their chief residence. In 2022 Winnie gives birth to twins and the couple sells their condo to purchase a 4-bed business firm. The sale is protected past the safe harbor and Howard and Winnie may claim a partial tax exclusion.

Example four: In 2021 Bruce buys a high-ascension condo unit and uses information technology every bit his main residence. His monthly condo fee is $400. Only 3 months after moving in, Bruce'southward condo association replaces the edifice's roof and heating organization. Half dozen months later, Bruce's condo fee doubles every bit a upshot of the repairs. Bruce sells the condo in 2022 considering he can't afford both the new condo fee and his monthly mortgage. The safe harbor does NOT apply, fifty-fifty though Bruce tin no longer afford his housing costs. However, under the facts and circumstances, the main reason for his auction, i.e., doubling the condo fee, is an unforeseen circumstance considering Bruce could non reasonably have anticipated the fee would double when he bought the unit. Consequently, the sale is due to unforeseen circumstances and Bruce may merits a fractional exclusion.

Instance 5: In 2021 Chris buys a house equally his principal residence. The business firm is located on a heavily traveled road. Chris sells the business firm in 2022 because he is bothered by the traffic noise. The safe harbor does not apply. Because the main reason for the sale is traffic noise it is not an unforeseen circumstance and Chris cannot claim a partial exclusion.

Case 6: In 2021 Diana and her fiance Eliot buy a house to live in as their primary residence. In 2022 they cancel their hymeneals plans and Eliot moves out. Diana cannot beget the monthly mortgage past herself, so they sell the house in 2022. The rubber harbor does non use. Withal, nether the facts and circumstances, the main reason for the sale, the cleaved engagement, is an unforeseen circumstance considering Diana and Eliot could not reasonably have anticipated it when they bought the house. Therefore, they are each entitled to a fractional tax exclusion.

Example 7: In 2021 Frances buys a small condo as her primary residence. In 2022 she gets a promotion and a big salary increase. She sells her condo and buys a house because at present she can afford it. The safe harbor does non use. The main reason for the auction, the bacon increment, is an improvement in Frances'south financial circumstances. An financial improvement, even if due to unforeseen circumstances, does non qualify for partial tax exclusion.

Example 8: In April 2021 George buys a house to apply as his principal residence. He sells the firm in Oct 2022 because it has greatly appreciated in value, mortgage rates have declined, and he can now afford a bigger house. The safe harbor does non apply. The main reasons for the auction, the alter in house value and mortgage rates, are a financial improvement, so George does not qualify for a partial exclusion due to unforeseen circumstances.

Example 9: Hudson works as a police officer. In 2021 he buys a condo to use as his primary residence. In 2022 he is assigned to the city's K–9 unit and is required to care for his police force service canis familiaris at his domicile. Because Hudson's condo clan does not permit canis familiaris ownership, Hudson sells the condo in 2022 and buys a house. The safe harbor does non apply. However, under the facts and circumstances, the reason for the sale, Hudson'southward assignment to the Thousand–ix unit of measurement, is an unforeseen circumstance because Hudson could non reasonably take predictable this at the time he purchased the condo. Consequently, Hudson may merits a partial exclusion.

Example 10: In 2021, Jennifer buys a small firm to use every bit her primary residence. Jennifer wins the lottery in 2022 and sells her business firm to buy a bigger, more expensive house. The safe harbor does not apply. The chief reason for the sale is a fiscal improvement and does not qualify for a partial tax exclusion.

Great, y'all're eligible for a partial exclusion! How is information technology actually calculated?

It'southward a percentage.

Hither, the IRS will multiply the maximum allowed exclusion (i.e., $250k / $500k) past a fraction.

The numerator is the lower of EITHER…

- (a) the duration the home was endemic AND used every bit the taxpayer'due south primary residence (looking dorsum 5 years from the sale), OR

- (b) the duration from the taxpayer'southward most recent prior sale for which capital gain was excluded under Section 121 to the appointment of the electric current sale

The denominator is: ii years.

The numerator and denominator must use the same unit of time, so if you're using days for i y'all too take to utilize days for the other; if you employ months for i, you must use months for the other.

Let's look at some examples.

Instance one: On January i, 2020, Monica buys a home for utilise equally her primary residence. 18 months after on July one, 2021, she sells the home because her chore gets transferred to some other state. Monica may exclude up to $187,500 of proceeds from taxes: that's $250k * 18 months / 24 months.

Example 2: On January 1, 2019, Jordan buys a house as his primary residence. On January 1, 2021, Jordan marries Holly and she moves in. On January 1, 2022 (12 months subsequently Holly moves in), they sell the business firm due to a valid task modify. Because merely Jordan has satisfied the 2-yr residency requirement, the couple cannot get the full $500k tax exclusion. Instead, their exclusion will exist determined past calculating what each person would get had they non been married. Jordan can exclude his full $250k gain because he satisfies the residency requirement. Although Holly does not satisfy the residency requirement, but she can merits a partial exclusion due to the job change. She can exclude up to $125k, which is $250k * 12 months / 24 months. Therefore, the couple tin claim a combined exclusion of $375k.

Detect one VERY important particular: Fractional exclusions when y'all FAIL to meet the residency requirements are calculated by multiplying the appropriate fraction by the MAXIMUM permitted exclusion of $250k / $500k, and Not by the Actual realized proceeds.

In reality, then, getting a partial exclusion when you lot Fail the residency requirement quite oft means you can all the same stop up excluding the ACTUAL unabridged proceeds from your home sale! That is truthful if your actual gain falls brusque of the maximum permitted exclusion.

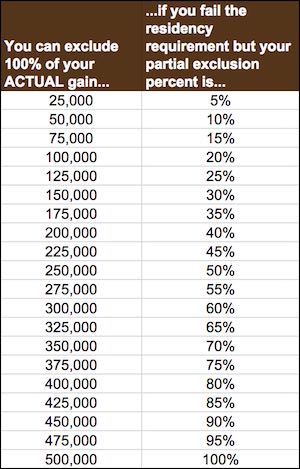

In fact, if your bodily gain is as shown below, you'll however be able to exclude the full amount if yous Neglect the residency requirement as long as your partial exclusion percentage is the corresponding amount:

By contrast, getting a partial exclusion when you PASS the residency requirement means you volition definitely exclude LESS than your Actual gain. That's because the fraction (1 – mail service-2009 nonqualified use / full ownership duration) is applied against your Actual proceeds, not the MAXIMUM permitted gain of $250k / $500k.

And then if your bodily gain is, say, $100k when you lot PASS the residency requirement, you'll simply become to exclude a fraction of that if you lot accept Whatsoever nonqualified use. Whereas if your actual gain is $100k when you FAIL the residency requirement, y'all tin can withal exclude all of it as long equally your applicable fraction is at least 40% if you're a single filer ($100k / $250k) and 20% if y'all're a joint married filer ($100k / $500k).

Is your mind blown all the same?

What the IRS is incentivizing with this is maneuvers to AVOID the residency requirement while creating a valid exception to still get a partial exclusion.

I final thing on calculating the partial exclusion corporeality.

If the taxpayer acquires a replacement home following a home conversion qualifying for a partial exclusion, the ownership and residency period carries over to that replacement domicile if the replacement home'south cost footing is determined using the involuntary conversion rules of Section 1033(b) of the Internal Revenue Code.

Example: On January 1, 2012, Sean buys a house as his chief residence that costs $200k. On January 1, 2022, a tornado destroys his house. Sean gets $550k from his insurance company. The destruction of his firm qualifies for gain exclusion nether both Department 121 and Section 1033.

Sean so buys a new business firm for $280k. Considering he tin can exclude up to $250k of gain from taxes, for purposes of Section 1033, the amount realized is "adjusted" to $300k ($550k insurance gain less $250k exclusion) and the taxable portion of that is $100k ($300k "adapted" amount realized less $200k original habitation price basis).

Since Sean bought a replacement home for $280k, he recognizes proceeds of $20k and pays taxes on it now ($300k "adapted" amount realized less $280k replacement domicile price). The remaining $80k is tax-deferred ($100k taxable gain less $20k already taxed). The cost basis of the replacement dwelling house is $200k ($280k price less $80k deferred gain). And Sean'southward x-year buying and residency menses from the original house carries over to his replacement house.

Two terminal notes about chore changes, health, and other unforeseen circumstances

In that location'south a couple issues open to estimation about the exceptions for job changes, health, and unforeseen circumstances.

I is whether the same safe harbor tests that utilise to partial exclusions when yous Fail the residency requirement likewise employ to the nonqualified use exceptions when you PASS the residency requirement.

It seems reasonable that they would, but the Treasury Regulations Section 1.121–3 don't explicitly ostend this.

The regulations were written to address cases where you lot fail the residency requirement. Just the nonqualified utilise exceptions came later on and only went into result in 2009 — years after the regulations were already published.

Absent explicit IRS guidance to the contrary, I recommend y'all assume the aforementioned safe harbor tests apply in both cases.

2d is the nonqualified use exception that grants leniency for temporary absences not exceeding two years due to task change, wellness status, or other unforeseen circumstances.

Information technology'southward not entirely articulate what happens when an absence due to one of these reasons lasts LONGER than 2 years.

If you have a health condition that requires you to live away for 2 years plus ane day, does that mean the first 2 years are validly excepted from nonqualified utilise while the last 1 twenty-four hour period counts as nonqualified use? Or does it hateful nothing days are now validly excepted and therefore y'all cannot claim this exception at ALL?

I oasis't seen clear IRS guidance on this, so information technology's something to discuss with your tax advisor.

Depreciation recapture

1 other thing you lot should know is how Department 121 interacts with depreciation recapture.

Depreciation recapture is where the IRS taxes you when you lot sell your domicile for any cost basis yous depreciated while owning your dwelling house.

Typically, you'll depreciate your cost basis (property value simply, not land value) when you rent out the home to a tenant. This helps offset your rental income which in turn lowers your taxation liability.

You lot'll typically depreciate using a straight-line method over a 27.5-year horizon. Your cost basis declines correspondingly with each depreciation deduction.

Incidentally, you should Always accept the depreciation deduction.

Don't think you lot'll "save your price basis" and avoid depreciation recapture by but forfeiting the depreciation deduction.

When you sell your home, the IRS automatically assumes you accept taken the depreciation deduction to its maximum extent for the entire flow you lot rented out the property.

So the IRS taxes you lot on depreciation recapture whether you actually took the depreciation deduction or not. There is no way to avert this. So you should E'er take the depreciation deduction and find income to offset information technology against.

Google any of this if it'south news to you lot.

Anyway, when you sell the home, the IRS will tax you on any amounts you depreciated if your auction price exceeds your depreciated price basis.

The IRS will tax you a apartment 25% on depreciation recapture, regardless of your ordinary income revenue enhancement bracket.

Whatsoever capital gains above and across the depreciation recapture is taxed at normal capital gains rates, typically the long-term rate of 15% (or nil if you satisfy the requirements of Section 121).

What you have to know about how Section 121 interacts with depreciation recapture is that Department 121 exclusions and limitations never utilise to depreciation recapture.

Section 121 just ignores depreciation recapture and focuses solely on pure capital gains.

A quick example:

Say you buy a house for $100k. $40k is property value; $60k is land value.

You live there for 2 years. Then yous hire information technology out for two years. Y'all make no major improvements during that time. In each of those 2 rental years y'all should depreciate $one,454.55 of the $40k property value and deduct that from your rental income. $1,454.55 = $40k / 27.5 years.

At the end of 4 years you sell the house for $250k. Your cost basis now is $97,091 = $100k – ($1,454.55 * 2).

You lot volition pay 25% tax on the difference betwixt your original cost basis of $100k and your electric current cost basis of $97,091, and so you'll pay 25% tax on $two,909 REGARDLESS of what Section 121 says.

Then, having satisfied all the requirements of Section 121, you'll pay zero taxes on the adjacent $150k of gain, which is the deviation betwixt your original cost basis of $100k and the auction cost of $250k.

Section 121 won't help you with depreciation recapture even though you're withal well nether the $250k exclusion cap.

All right, big post…and we're curious what y'all take to say!

What other tips or strategies do you use to do tax planning for your domicile?

Let us know in the comments below!

Plus: Interested in building massive wealth with real estate?

Then be sure to check out my real estate firm hacking posts, which explicate step by step how we're creating real estate wealth by having others pay our mortgage on multi-million dollar existent estate.

Source: https://hackyourwealth.com/home-sale-capital-gains-tax-exclusion

0 Response to "Avoid Capital Gains on Home Sale to Family"

Post a Comment